Record Loan Payment In Quicken For Mac

Visit: Quicken Loans Mortgage – Splitting Your Home Loan. Does your transaction keep you up at night?

If so, you're not alone. Majority of folks shows that a majority of Americans now say they are worried about creating their rent or mortgage loan expenses. The good news is that there are ways to get a grip on your transaction monthly.

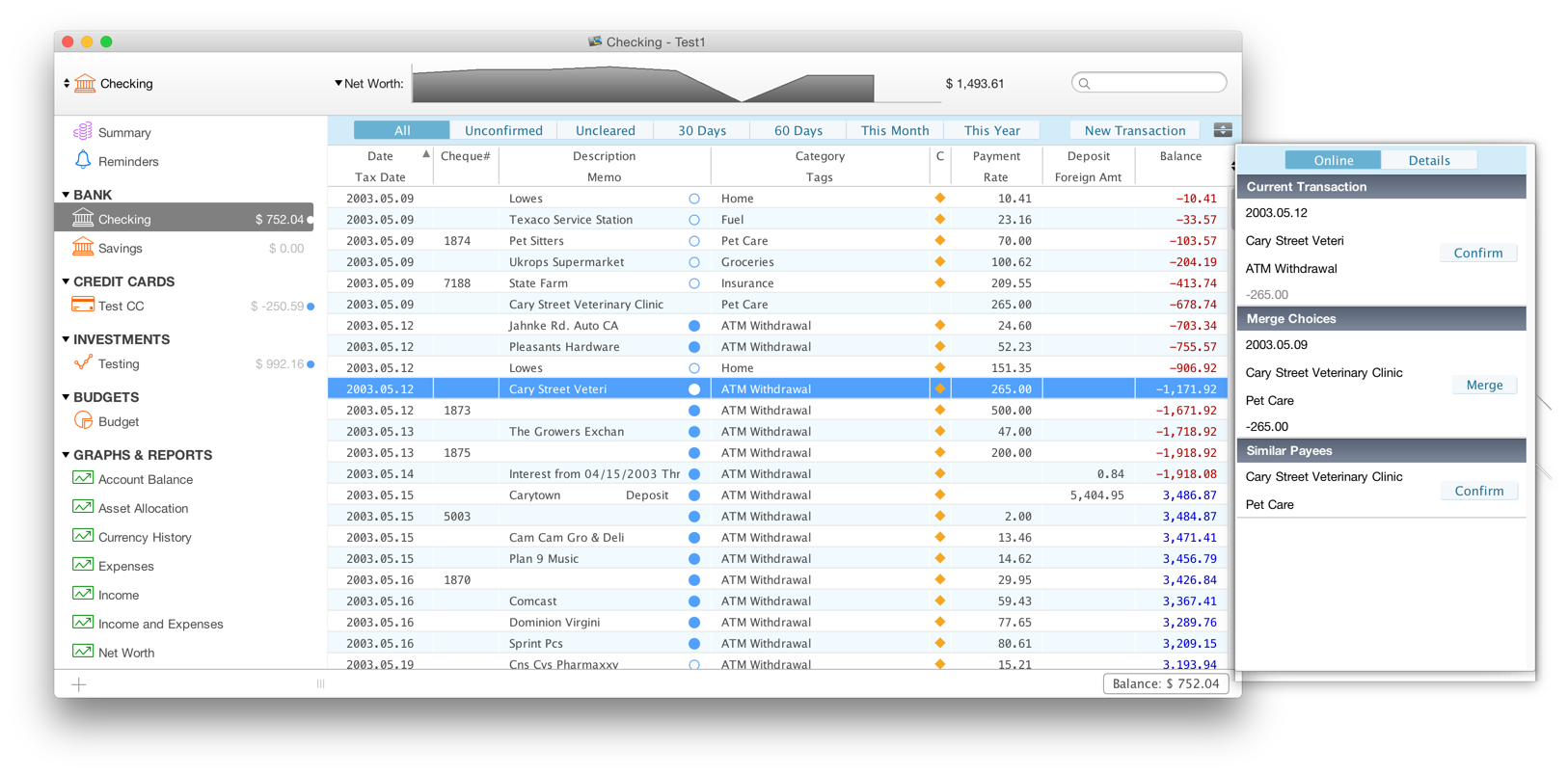

Using a loan reminder. When your loan payment is due, Quicken reminds you to enter the payment into your register. If you don't want to wait for the reminder, click the loan name in the Account Bar, click the Account Actions icon, and then choose Enter Loan Payment.

Subscribe Now: Watch More: Displaying numbers with exponents in Excel will require you to enable a very specific function of the program itself. Expert: Justin Conway Filmmaker: Nick Laden Series Description: The Microsoft Office suite of programs, including Excel and Word, are some of the most widely used productivity tools in the world. Exponent in excel for mac download. Display numbers with exponents in Excel with help from an expert with more than a decade of experience working with Microsoft Office and Adobe Creative Suite in a professional capacity in this free video clip.

Here are some quick tips that can help you manage your transaction monthly and preserve money: 1. Re-finance - This is the first thing that usually comes to mind when people want to reduce costs on their transaction. Even with home equity in query, refinancing is not necessarily out of the query. With programs like the FHA streamline, FHA loan holders can refinance without an appraisal.

And with mortgage loan rates as low as they are, there's never been a better time to refinance. Talk to a Home Loan Expert about your options. Create Additional Payments - Did you know that you can slightly change the way you are creating your transaction (without any type of special loan program) and preserve money? Instead of spending your monthly transaction, you can split your single, transaction monthly into two bi-weekly expenses every Friday (or whenever you get paid, if you're on a bimonthly transaction schedule).

If you did this for a season, you'd make 26 half-payments (there are 26 two-week periods in one year). Making 26 half-payments means you've made 13 full home. By splitting your transaction in 50 percent and spending it every two several weeks, you're actually creating an additional transaction which will preserve you interest levels over the life of the loan.

You can organize this without spending the half-payments to the bank. Simply open another checking or banking consideration and deposit your half-payments into it every two several weeks. When your transaction monthly is due, make that transaction from the new consideration. At the end of the season there will be enough cash in the consideration to make an additional mortgage loan payment!

Just be sure to apply it to your principal balance. Property owners Insurance policy - Purchasing around for a better deal on homeowners insurance plan is a great way to preserve some extra cash. But did you know that there's a benefit to doing your research beyond the lower top quality payment? If your transaction includes taxes and insurance, be sure to notify your bank. If your top quality is significantly decreased you could request that your escrow be decreased or that you get a refund from your escrow consideration. These are just a couple ways of creating your transaction monthly a little more manageable. The cash you'll preserve each 30 days or over the life of the loan can be added to your emergency banking consideration so you're better prepared for any type of economic needs that may arise in the future.

When I set up a loan (and set up the loan payments), it appears that Quicken *DOES NOT* adjust the Interest-Principle split according to my payment date.instead, it uses (apparently) the value that it has already calcuted for the split, assuming that the payment posts to the loan account exactly on the due date. In case that doesn't make sense.let me clarify: If I make my payment a week early, then less interest has accrued, and therefore more of my payment goes to principle. So, If I change the payment date when entering my scheduled payment in Quicken, then I expect Quicken to adjust the split. However, as far as I can tell, Quicken does not do this.

Best video player for mac os x lion. Get now the Best video players for Mac OS X, including Elmedia Player, VLC Media Player, mpv and 8 other top solutions What are the best video players for Mac OS X? The commercial reaped praises and won an award in the 31st Cannes Lions International Advertising Festival in 1984, and it. What are the best video players for macOS? MPlayerX does not support retina display on OS X older than Mountain Lion, but amount of Mac’s with older OS X are quite rare nowadays See More. VideoPlayerforMACOSX – Which is the best video player for Mac? See the list of top 10 best Video players for MAC OS X. If you like watching videos and movies on your MAC OS X, you should have good powerful video players which can support any format and give the HD view of all. • Wide support for different operating systems: Mac OS X, Windows, Linux, Android, iOS, etc. • Integration with web channel streaming services. 5KPlayer is a basic video player for Mac OS X. It’s a bit of a mixture of free (MKV) HD video player, music player, AirPlay media streamer. This best media player for Mac is slick and easy to use,allows editing and conversion. QuickTime lets you view Internet video, HD movie trailers, and personal media. Video Format: QuickTime Movie (.mov) MPEG-4 (.mp4,.m4v) MPEG-2 (OS X Lion or later) MPEG-1 3GPP 3GPP2 AVCHD (OS X.